Major Tax Breaks for Homeowners

Major Tax Breaks for Homeowners Have you ever wondered what the major tax breaks for homeowners are? If you recently bought a house, you might have found yourself paying a lot of money in the first few years. Between a downpayment, closing costs, home insurance, and any fees, you might just feel like you’ve signed […]

Eight tips on how to talk about money with kids

Eight tips on how to talk about money with kids Successful families talk about finances. Passing traditions, values and beliefs onto the next generation isn’t happenstance. The older generation must cultivate their wisdom and experience and communicate it to the younger generation and learning how to talk about money with kids is no different. Once […]

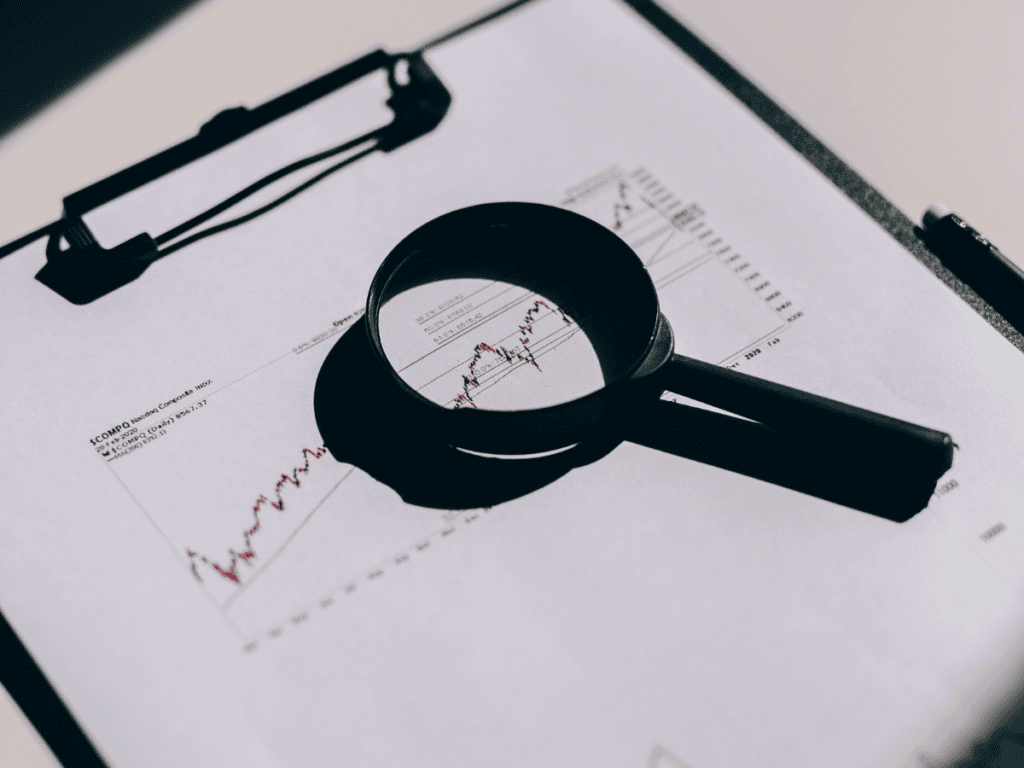

11 Tax Deduction Tips that Can Save you Hundreds

11 Tax Deduction Tips that Can Save You Hundreds (Part 2) Are you missing out on some serious tax deductions? It might surprise you that the most overlooked tax deductions can save you the most money. No one likes to pay more money than they should, and taxes are no exception to the rule. With April 17 […]

5 Tips to Increase the Value of Your Accounting

5 Tips to Increase the Value of Your Accounting With tax season in full swing, you may be looking for ways to increase the value of your accounting. Maybe you’re hoping to expand your client base. Or perhaps you’d like to give your loyal customers a service upgrade. Whatever the reason, you can implement some […]

How to attract quality referrals online and by social media

How to attract quality referrals online and by social media In today’s internet reliant world, business need to attract quality referrals online and by social media in order to thrive. This article covers the basics of how you can transform online hits and social media likes into clients. Unfortunately, not all social media likes and […]

Foolproof ways to pay off student debt

Foolproof ways to pay off student debt If you feel trapped in an endless cycle and find yourself looking for foolproof ways to pay off student debt, then this article is definitely for you. Paying off student loans can have you feeling like a hamster caught in a wheel, but it does not have to […]

Why small businesses can benefit from outsourcing

Why small businesses can benefit from outsourcing For many, the idea that small business can profit from outsourcing some tasks might not sit well. But there’s definitely a benefit to dropping the conventional mode of hiring a specially trained employee in parts of your business that are more on the operative side than the functional […]

4 Tax-effective retirement strategies

4 Tax-effective retirement strategies These tax-effective retirement strategies can keep your taxes in check as you start another chapter of your life. Read on for a look at how you can manage just how much of your retirement income is taxed. Retirement is an exciting time. If you don’t understand the principles behind taxable income […]

Steps to a Successful Safety Audit

Steps to a Successful Safety Audit Safety is paramount to every business, and as a business owner you need to know what are the essential steps to a successful safety audit. If you’re looking for good tips on how to make the work environment a safer place, keep reading. Do you need to know […]

How to ask your clients for good referrals

How to ask your clients for good referrals As a business owner you should know how to ask your clients for good referrals. No one goes into business to settle for a mediocrity growth rate. You want to grow your business. You want more of your prospective clients to enjoy what you have to offer. […]