Top eleven behaviors to avoid when on a tight budget

In this article we are going to examine the top eleven behaviors to avoid when on a tight budget.

So, we know looking for a job isn’t easy. In fact, it can be flat out stressful.

But you know what’s even worse? Being on a limited, or fixed, income without a safety net.

Whether you’re newly unemployed or a freshly out of college, the fact of the matter is you must to be cautious about the money you have right now.

You need money set aside you can fall back on in the event of an emergency. More importantly, you also need enough money to pay your bills.

Let’s face it: there are probably plenty of things you spend money on every day that you could do without.

It might be high time you reassess your budget. Start by taking a look at top eleven behaviors to avoid when on a tight budget.

1. Getting into debt

On a fixed income? The last thing you need is another credit card or loan.

Taking out a small loan or opening another line of credit might seem like a great fix initially, but don’t forget that you have to return the money you borrow on top of any interest you accrue.

Odds are if you’re on a tight budget, you don’t have the extra money to pay back the interest.

And the problem with using credit on a tight budget is it can spiral out of control.

It might seem like an extreme, but it’s actually very easy to find yourself using one credit card to pay another when things are lean.

Don’t do it.

Use your credit card sparingly when you’re on a budget and keep the increments small and manageable.

And whatever you do, avoid the temptation to open a new account until you’re in a more stable position financially.

2. Online shopping

Here’s another habit that can be hard to break.

But breaking it can be well worth it in the long run if you’re tight on cash flow.

Think about the things you typically buy online for a moment.

Most likely, about 99 percent of the things you purchase aren’t considered necessities.

And, even if you use bargain websites, your shopping cart totals can rack up.

That’s not to say you have to deny yourself the pleasure of online shopping for eternity. Instead, just make an effort to purchase things you need or really want when they’re on sale or if you happen to get a significant discount through a coupon or promotion.

3. Dining out/nights out

Sure, once in a while a night out with friends or a good pre-cooked meal isn’t going to hurt.

The key here is to keep how routinely you go out down to a minimum.

It’s probably unwise to eat out every day or even every week. But you can treat yourself occasionally.

Another thing you want to avoid: spending too many weekends partying with your friends.

As mentioned before, once in a while won’t hurt. But even then, be careful about how much you spend at these kinds of outings.

It’s really easy to end up spending way more than you planned when you’re out and about with friends, especially if you’re drinking.

Likewise, try to be frugal when you do go out. Instead of meeting friends for a full out meal, don’t be afraid to suggest meeting for drinks or coffee. You can also try to cut down on your bill by suggesting meeting at a restaurant during their happy hour.

4. Uber/Lyft

Sure, if you don’t have a car, ride-sharing apps Uber and Lyft are a great deal.

But sometimes you have to think about how often you’re using these kinds of services. If you’re using these kinds of services to attend interviews, than yes, the benefits outweigh the costs.

However, if you’re regularly using a ride sharing service to go out with friends, hit the gym or head to Starbucks, it’s probably time to rethink that.

The fact of the matter is while Uber or Lyft are cheaper than some taxi services, your bill can really rack up, especially if you use them often.

Instead, try taking public transportation or riding your bike.

5. Purchasing what you can borrow

It’s nice to have your own things, no one can deny that.

But when you’re on a budget there’s are times when you need to compromise.

Of the top eleven behaviors to avoid when on a tight budget, one of the biggest one is to avoid purchasing things you can just as easily borrow.

This doesn’t necessarily mean you should go around neighborhood borrowing sugar and flour, but it does mean when the option arises to be thrifty you should take advantage of it.

For example, let’s say you’re heading out of town for a professional conference and need a high quality camera to take pictures with for your website or social media page.

You could drop three-hundred dollars on a brand new camera for this conference. Or you could just ask to borrow a similar camera your friend happens to own.

This is an especially good idea for those things you’re only going to use one time and never again.

You don’t need to invest money in the things you’ll rarely use, and since it’s unlikely you’ll be asking to borrow them often, most people will be willing to give you a loan.

6. Daily Starbucks

You’ve probably heard this one a lot. But truly, this is a major one of the top eleven behaviors to avoid when on a tight budget. It can also be the easiest to avoid.

Starbucks is a great convenience, but on a budget, it’s a convenience you can’t afford–especially every day.

Why?

Well, spending five to seven dollars each day can really add up. Let’s say, for argument sake, that you spend an average of $5 per day on your regular Starbucks drink.

That’s $35 dollars a week, or about $140 a month. In a lot of cases, that’s money that could go towards paying utility bills like water, trash and sewer.

Instead, opt in for a nice pot of home brewed coffee and only rely on Starbucks when you need a treat.

7. Renting an expensive apartment

You may not think about it, but where you live can be a huge luxury.

For most people, rent is what eats up a large portion of their cash flow every month.

But when you’re on a tight budget, rent can be one of the most difficult things to make up.

Tax deductions can help put some money in your pocket. Here is a great article on the most overlooked tax deductions you can take advantage of now.

Don’t make the situation harder on yourself by renting an apartment which costs more than you can afford.

If you’re only bring in in about $240 every week on unemployment, the last thing you want is for the entire check going toward paying for rent.

If you find yourself in this boat, maybe it’s time you relocate or find a roommate.

For those who are fresh out of college, moving back in with your parents is also another option. It may not be the most ideal solution, but it can be a good move until you’re financially capable of living on your own.

8. Forgetting to budget

One of the worst of the top eleven behaviors to avoid when on a tight budget not budgeting.

Self-control and discipline are two things everyone needs to master in order to live a happy, healthy life in terms of financials.

If you run to the bank, cash your check and instantly start spending on things you can probably do without, it’s time to reassess your priorities.

Budgeting is a good habit to have no matter your financial circumstances, but its also something that can keep you out of debt when things are tight.

The key here is to make a list of the important things you need to pay first. These include:

Top Eleven Behaviors to Avoid When on a Tight Budget

- bills

- groceries

- adding money to your savings

- health expenses

Once you’ve paid all of these things, you can then evaluate any money you have left over. Although most of the time it’s a good idea to set any extra money aside when you’re on a tight budget, treating yourself every once in a while won’t hurt.

9. Lending money

Sometimes helping other people out is the best feeling in the world. The spirit of giving, however, can turn into a problem when you put others over your own well-being.

We’ve all heard of those people who give their last dime to help others. And that’s a good behavior to cultivate in yourself–except when every last cent counts.

Not to say you should never give money to others. But when you’re on a budget, you need to be very cautious about giving or lending money to other people when you could be using those funds to pay rent or your bills.

Even after you’ve paid your bills, you want to be putting money aside in case of an emergency. When you give money away, that money is taking right out of your safety net.

It’s not easy, but try to refrain from lending money out to friends or family when you’re on a budget.

If you’re really adamant about helping someone out, try doing something for them instead of giving.

For example, if a person is going through a tough time financially, offer to watch their kids while they’re out looking for jobs or whip up a home cooked meal.

There are lots of things you can do to aid others without putting your own financial health at risk.

10. Holding out for the dream job

This is a problem that a lot of college graduates run into after college. You get your degree and are suddenly faced with the reality that life doesn’t always go the way you’ve planned.

The mistake a lot of graduates make is choosing to hold out for their ideal position or paycheck instead of buckling down and trying to make money any way they can.

There are two ways this hurts instead of helps:

- You earn little to no money during that time

- You earn little to no experience as well

Simply put, when you’re not earning any income, you can’t pay your bills.

At the same time, the lack of a job–no matter how big or small– also makes you less likely to get hired in the future.

Why?

Employers are typically looking for people that present themselves as self-starters and have the “fire-in-the-belly” to make things happen.

While you might be holding out for your ideal job, what employers see on your resume is a lot of idle time.

If want to pay your bills now and in the future, then you need to be willing to embrace the jobs you do land– even if they’re not exactly what you hoped.

Sometimes this will mean freelancing. Other times that will just mean taking on the under paying job.

Just remember: you’re not married to this job for life. It’s just a stepping stone to help you land the job you’ve always wanted.

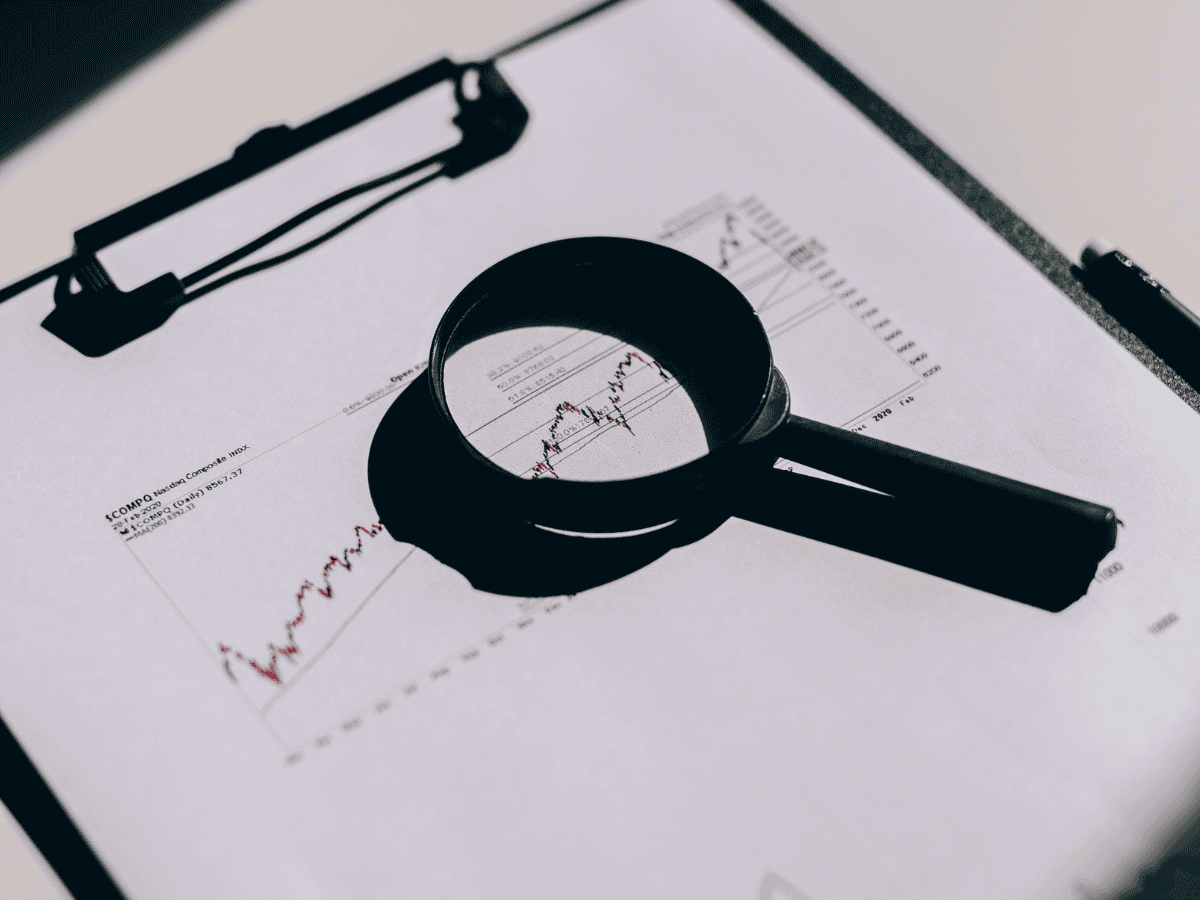

11. Failing to save

If you’ve read through this post by now, you might have noticed one common theme running throughout all of these tips: the importance of saving money.

If there’s any one particular behavior of the top eleven behaviors to avoid when on a tight budget, failing to save money is king.

Keep in mind, when money is tight, you’re more susceptible to finding yourself in debt because of an emergency or unexpected expense.

Interested to learn a little about Individual Retirement Accounts (IRA)? Here are five reasons to contribute to an IRA today.

This is why you need to set money aside. When you have a healthy savings, you’re more prepared to address those unplanned expenses and less likely to depend on a loan or credit to help you get through it.

More importantly, having savings, helps you address those times when things get particularly lean, like when your unemployment check is delayed.

Set money aside whenever you can, even when finances are really good. You never known when those funds just might come in handy.

Conclusion

Now that you have a clear picture of top eleven behaviors to avoid when on a tight budget, you’re better prepared for whatever the future might bring.

Remember, even when finances aren’t tight, budgeting is never a bad idea. Maintaining a list of dos and don’ts that are specific to your finances and setting aside a savings goal for every paycheck enables you to take on the world when the going gets tough.

As with all finances, weathering through tough times is all about coming up with a game plan and sticking to it.

So craft a financial plan that works best for you and you’ll always be prepared for whatever life brings.

Before you go, what are some other behaviors that we can all avoid when on a tight budget?